How Can a S&P 500 Heat Map Help You Make Smart Investments?

In order to understand what makes your business or company s&p 500, you need to understand what the definition of it is. So, what is the definition of S&P 500? It is a rating system used by Wall Street brokers to rate companies based on the businesses’ potential. It rates the companies on their financial health and their ability to generate profits.

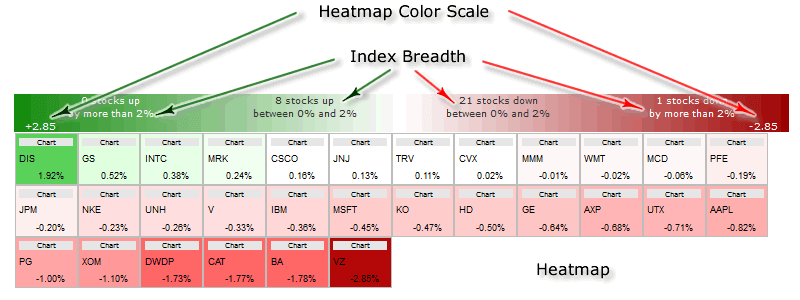

Let’s take a closer look at this S&P 500 heat map. The top portion shows the income of the company. The bottom portion shows the net worth or value that the company has. You can clearly see that a company that has high revenue would have a higher value in the market. On the other hand, a company that has low revenue would have a lower value in the market.

Now let’s explore further the heat map. The most dominant colors in the map are red, yellow, and green. The other colors are mostly related to the industry that the company is engaged in. For instance, industries that are mostly found in the health care industry have shades of pink and blue. Companies that manufacture medical devices have shades of green and yellow.

As you can see, a heat map allows investors to easily visualize, analyze, and compare a company’s performance based on different factors. For example, the profitability of a company is determined by two main factors, the customer base and its profitability. It is through the analysis of these factors that investors can tell if the company is profitable or not. It is also through this analysis that the company can be categorized into sectors and forecast how its sales and earnings will evolve over a period of time.

Now here’s a helpful tip that you can implement. Try making your own heat map. What you would do is to use Microsoft Excel to plot charts and maps. Just select the “Map” option from the “chart” menu and then choose “heat map”.

To create a heat map, just copy and paste the below data into Microsoft Excel and then highlight all the columns in the data set. Now, right click on the highlighted data and choose “Map” from the drop down menu. Choose “heat map” from the drop down menu and then click OK. You should then see a chart showing the different colors of the company’s market sector.

As you can see, this tool is very useful for investors. It gives them an overview of a company’s performance. However, there is one caution here. The usefulness of this tool depends heavily on the kind of information you want to present about the company. If you are just trying to evaluate the financial performance of the company, you wouldn’t really need to use a heat map to this end.

Now, when it comes to evaluating the profit and loss statements, you might want to use a heat map to get a more detailed picture. You will be able to see what patterns exist in the price movements of the company. This will allow you to understand better the profitability and viability of the company. More importantly, you will be able to see which industries the company is competitive in and which ones they aren’t. With this knowledge, you will be able to make the proper moves to order to take the company to the next level.

Now, what if you are already an investor who has his or her fingers on the pulse of the company? Do you think it is still as useful as it was before? Of course it is. A heat map allows investors to keep track of the company’s growth in the past and predict its future performance.

Investors also use these charts to determine whether a stock is good or bad. Just like you do with any other tools, you have to be careful with heat maps. There is a high likelihood that they will overheat and under heat. So, you have to be careful to set your heat map according to the time frame you are using. Otherwise, it will look like a chaotic chaos instead of a nice and steady rise and fall.

Investing in stocks is one of the best ways to earn money. However, before you make a single investment, you have to at least consult a heat map. This tool will prove very helpful and give you much information about a particular company and its future performance.